Background

Retailers were interested in Flux for our ability to reconcile item-level data to customers, via banks. Our core B2B2C product was instant digital receipts delivered via banks. We wanted to explore how we could use the same API to reward customers based on their purchases.

Responsibilities

- Run exploratory research with loyalty users of other apps and schemes

- Run quick experiments to validate our assumptions.

- Define and test the user journeys. I run usability testing sessions throughout the design phase to catch usability issues.

- Define the UI

Research

I run exploratory research sessions with users of other loyalty apps and reward schemes, to understand what they liked and disliked about them. I also run research sessions with our retail partners, to understand where the existing solutions were failing them. This was a crowded market space, we needed something unique!

I observed that existing loyalty solutions added friction at checkout for both the retailers and the customers:

- For retailers, running a loyalty scheme quite frequently meant either having to add extra hardware at checkout (to collect a QR code, an email, or another unique identifier) or to rely on a more analog solution, like stamp cards (easy to fraud and hard to track).

- For customers, it was an extra card to carry or yet another thing to download & sign up to.

Our API already connected items to customers via bank, which meant we could deliver rewards and facilitate point collection without:

- Additional steps at checkout. No QR codes, no apps to download, no email to share. No need for any extra identifier.

- Extra hardware for the retailer. No staff training, no changes at till.

Challenges

- Convince large partners to cede part of their loyalty experience over to us. We did so by offering a white-labelled solution that integrated with their systems, instead of replacing them.

- Prove a good ROI for our instant cashback functionality. We did so by showing the retention of the customers they acquired via us.

Designs

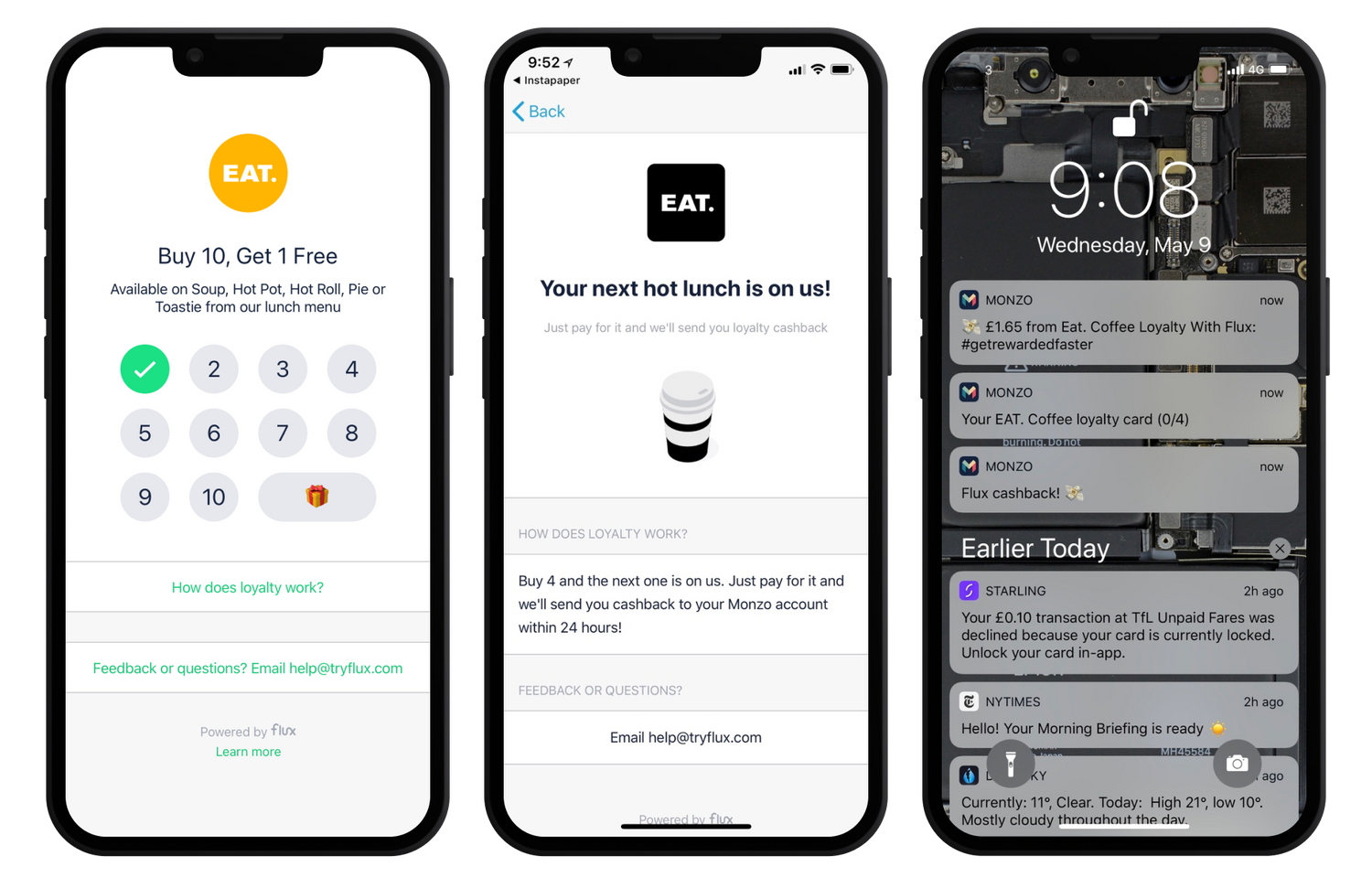

We turned a person's bank card into their loyalty card, removing the need to scan an extra card and reducing steps at checkout. Like our instant digital receipts, our loyalty solution was integrated and available within banking apps, which meant there wasn't any extra app to download or thing to sign up to.

All users had to do to collect points was to pay.

We designed two distinct solutions for the two types of retail partners we had:

- SMEs running stamp card based loyalty

- Large nationwide chains with their own existing loyalty schemes

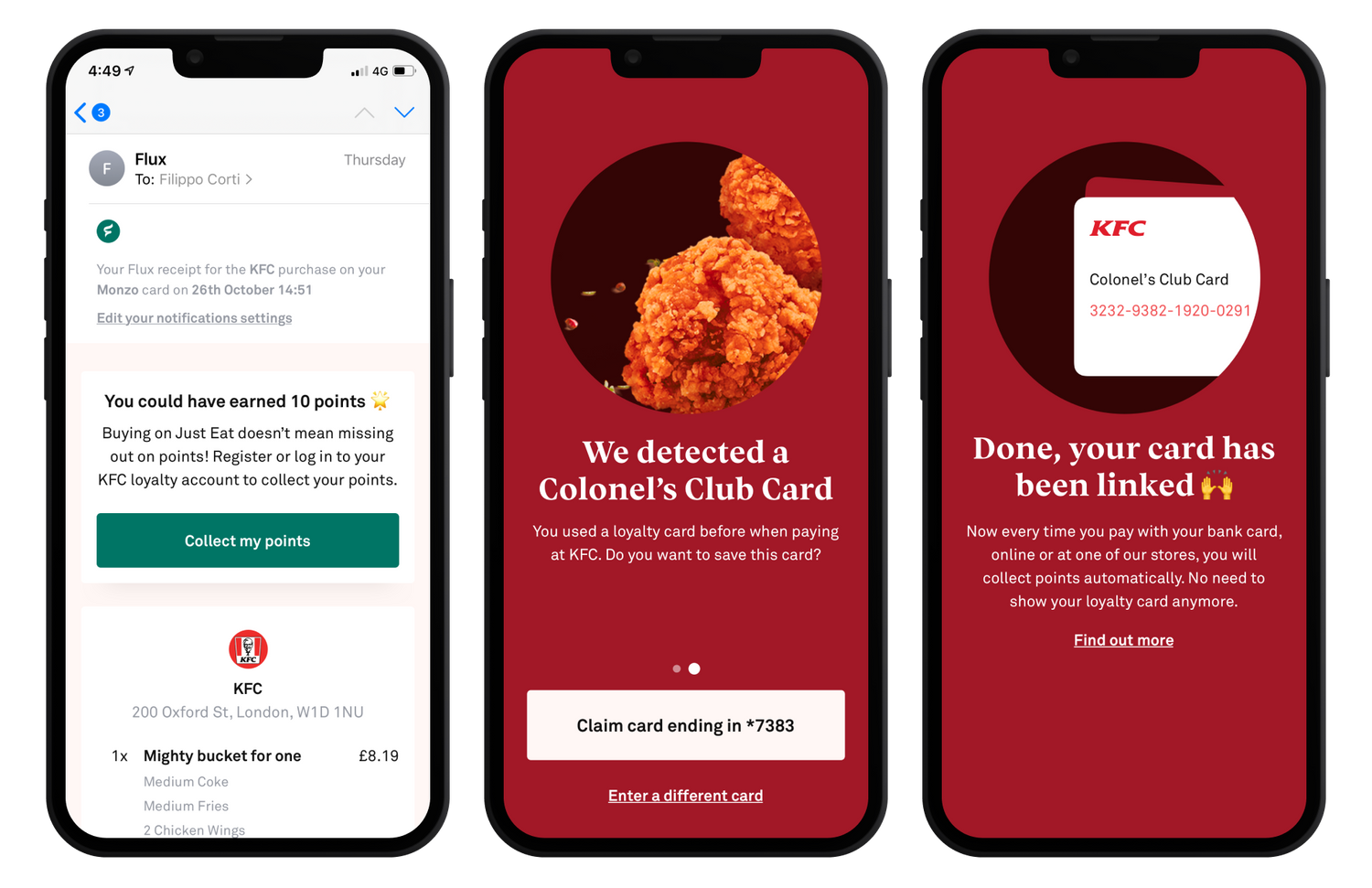

Whereas SMEs were running simple loyalty schemes — the kind of get your fifth coffee for free — larger chains had invested a lot in their own loyalty apps. During sales meetings and research sessions with our partners, we realised that they considered loyalty a pillar of their marketing strategy. To cater for them, we worked on a loyalty linking system which allowed existing loyalty schemes to be linked to bank cards.

Loyalty linking

We knew from our own data that retailers with loyalty schemes struggled keeping an active and engaged user base. The majority of their customers downloaded the app to soon forget about it. We found out 35% of users were missing out on loyalty because they forgot to scan their card, or couldn't be bothered with it. Which meant, in turn, that retailers were missing out on a lot of data.

We designed a white-labelled solution additional to a retailer's existing app. Instead of replacing existing loyalty schemes, we would drive traffic and usage to them. We did so by focusing on reducing friction at checkout and removing the need to scan a card to collect points.

The best interface is no interface

Sometimes, the best interface is no interface at all. It was clear no one wanted another app to fiddle with during checkout, and my aim when designing this functionality was for it to have the least amount of possible interactions. I aimed for something that a user could set up and then forget about, and would just work in the background.

Prototype for feedback: a trial with KFC

We worked closely with KFC Colonel’s Club loyalty program to allow a sample of Flux users to collect points automatically when transacting.

We chose to focus on users who had previously scanned a loyalty card. Given our unique ability to access a retailer's POS, we knew whether a customer had previously used a loyalty card during a purchase and were able to suggest a pairing automatically during their next transaction.

We did so via their banking app and by triggering an email notification when a card was detected. If the pairing was confirmed by the user, there would be no need to show it during future transactions.

We also allowed users to link a card manually. The functionality was available within receipts of supported retailers, directly in their banking app.

Stamp card loyalty

To help drive retention, for smaller retailers we focused on those disposable paper stamp cards cafes give out to their customers. Our strengths were in:

- Automatic stamp when paying

- Instant cashback when the reward was achieved

As per our linked loyalty system, all a user would have to do to get a stamp was to pay. If their transaction included an elegible item (e.g. a coffee, in case of a coffee loyalty card) we would display the relevant stamp card below their transaction, together with the digital receipt.

That meant stamp cards were available in the transaction feed of our partner banks, saving the need for the customer to sign up to, and download, a separate app.